For Small Businesses, Policies really matter

It's Just Math...and Money. John Mellencamp and Queen

Just before the pandemic in early 2020, I was asked to moderate a discussion for the National Association of Manufactures in Washington.

The two panelists were Jen Psaki, currently a host on MS NOW, and Dave Urban, lead strategist for President Trump’s 2016 in Pennsylvania.

Working with Jay Timmons, CEO of NAM, I was outfitted with a black and white striped referee’s jersey and whistle. We had anticipated some robust exchanges. None were had. Whistle remained dry.

(Prior to his tenure at NAM, Timmons was Chief of Staff to Governor and then Senator George Allen)

At a reception the night before, I had a conversation with a small manufacturing business owner from Georgia. My opening line to a conversation with most, if not all, business owners is…

How’s business?

Business owners LOVE to talk about their business.

Having come from a similar background, we quickly got on the same page. As she was explaining her business and the challenges that she was facing, I replied - “Policies matter.”

“Oh yeah. Policies matter. They sure do.”, she replied.

Given all the stresses of the pandemic, I hope she’s still in business.

The reason for the story is to illustrate that Small Businesses are disproportionately impacted by policy changes and rarely to the good.

Make that VERY rarely, if ever, to the good.

During my tenure in the House of Delegates, I was also serving on the Executive Committee of the International Bottled Water Association. IBWA, which I chaired in 2008, was a highly diverse trade association made up of companies from all over America and the world - including the world’s largest food company, Nestle.

Needless to say, we had our own robust conversations internally. Several of them ended up in the courts. Most were settled at the trade association level in order to present a unified front on what we could all agree would be good policy.

Legislators were dumbfounded when we go to the respective governing bodies and would ask for, in many circumstances, MORE regulation of our product. Consumer confidence in our products was absolutely essential to our success.

During all of those conversations both to legislators and actually being one, I coined and still use this phrase:

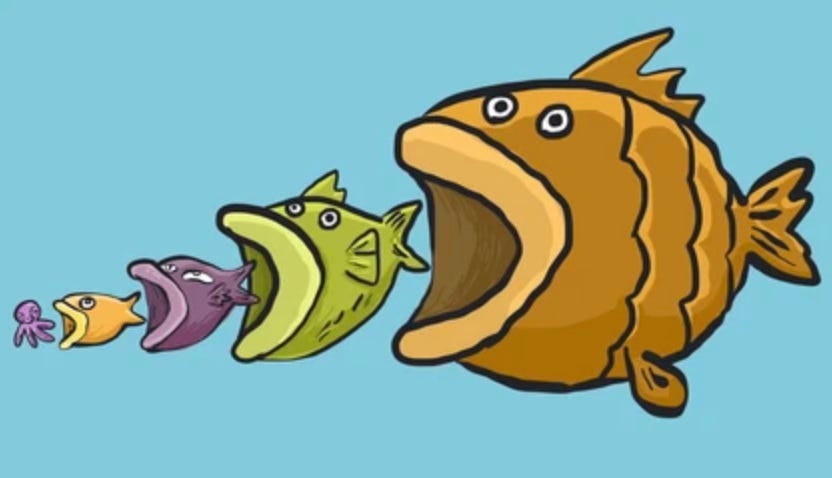

Regulations favor the favored.

At a certain point, complexity and compliance reach a point of diminishing returns.

The bottled water industry has gone under massive consolidation over the last 20 years; however, most of that was driven by factors outside regulating the actual production of putting water in a bottle.

The General Assembly is currently in its most torrid week of the Session as both the House and Senate prepare their bills to be sent to the opposite chamber.

Next week, the bills Crossover and the real fun starts or in many cases - collides.

Below is a little perspective memo I put together to help legislators and staff understand better how Small Business is impacted by their decisions.

I understood these instinctively because that’s how I grew up. Shenandoah Spring Water was quite literally a “mom and pop” shop- because it was my mom and dad - that grew and eventually was consolidated (gobbled) up.

Small Business Costs and Virginia’s Competitiveness in CNBC’s Top States for Business

Small businesses are central to Virginia’s economic dynamism, job creation, and regional resilience. However, higher taxes, expanding labor mandates, regulatory complexity, and litigation exposure impose disproportionate costs on small firms compared to large employers.

These pressures directly affect Virginia’s performance in CNBC’s Top States for Business rankings, particularly in categories measuring Business Friendliness, Cost of Doing Business, Workforce, and Economic Growth.

Why Small Businesses Absorb Costs Differently

Small firms lack scale to spread fixed costs such as compliance, legal counsel, and human resources.

Owners personally absorb administrative and regulatory burdens, diverting time from growth and sales.

Large firms amortize costs across thousands of employees; small firms experience them per hire.

Increased risk exposure leads small businesses to delay hiring or cap headcount.

Key Cost Drivers Affecting Competitiveness

Minimum wage increases: Raise base payroll costs and compress wage ladders, increasing total compensation expenses beyond the statutory minimum.

Paid Family and Medical Leave (SB 2): Introduces new payroll contributions, administrative complexity, and staffing disruptions that are harder for small firms to absorb.

Payroll taxes and mandated benefits: Increase the marginal cost of each additional employee.

Regulatory compliance: Expands record keeping, reporting, and audit risk.

Litigation exposure: Wage-and-hour and leave-related claims pose existential risks to small firms, unlike large corporations that treat litigation as a routine cost.

Data Callouts (Illustrative Impacts)

Labor costs typically represent 30–50% of operating expenses for small service-sector businesses.

A single additional mandate can raise per-employee costs by several thousand dollars annually for firms with fewer than 20 employees.

Temporary employee absences disproportionately affect small firms with limited redundancy.

Compliance and legal costs consume a higher share of revenue for firms with under 50 employees than for large employers.

Connection to CNBC’s Top States for Business Rankings

Business Friendliness: Rising fixed costs reduce Virginia’s relative attractiveness to entrepreneurs and startups.

Cost of Doing Business: Labor mandates and compliance costs weigh more heavily on small employers.

Workforce: Hiring constraints reduce entry-level and upward-mobility opportunities.

Economy: Slower small-business growth limits job creation and regional economic diversification.

Policy Implication

Virginia’s competitiveness depends not only on worker protections, but on whether small businesses can grow, hire, and scale.

Policies that do not account for firm size unintentionally advantage large companies, increase market concentration, and weaken business dynamism—factors directly reflected in CNBC’s rankings.

Size-sensitive policy design, administrative simplicity, and predictable legal environments are essential to sustaining Virginia’s position as a top state for business.